Granada Gold Mine Inc.

Seeks for Investors in China

Company Profile

Granada Gold Mine Inc. (OTCPK: GBBFF | TSXV: GGM | Frankfurt: B6D) is a Canadian junior mining and exploration company with Gold property in Quebec. Market value C$ 17,125,647. Owner of Granada Gold Mine.

Mineral Classification

Gold.

Gold Project Profile

Ø Flagship Project: Granada Gold project.

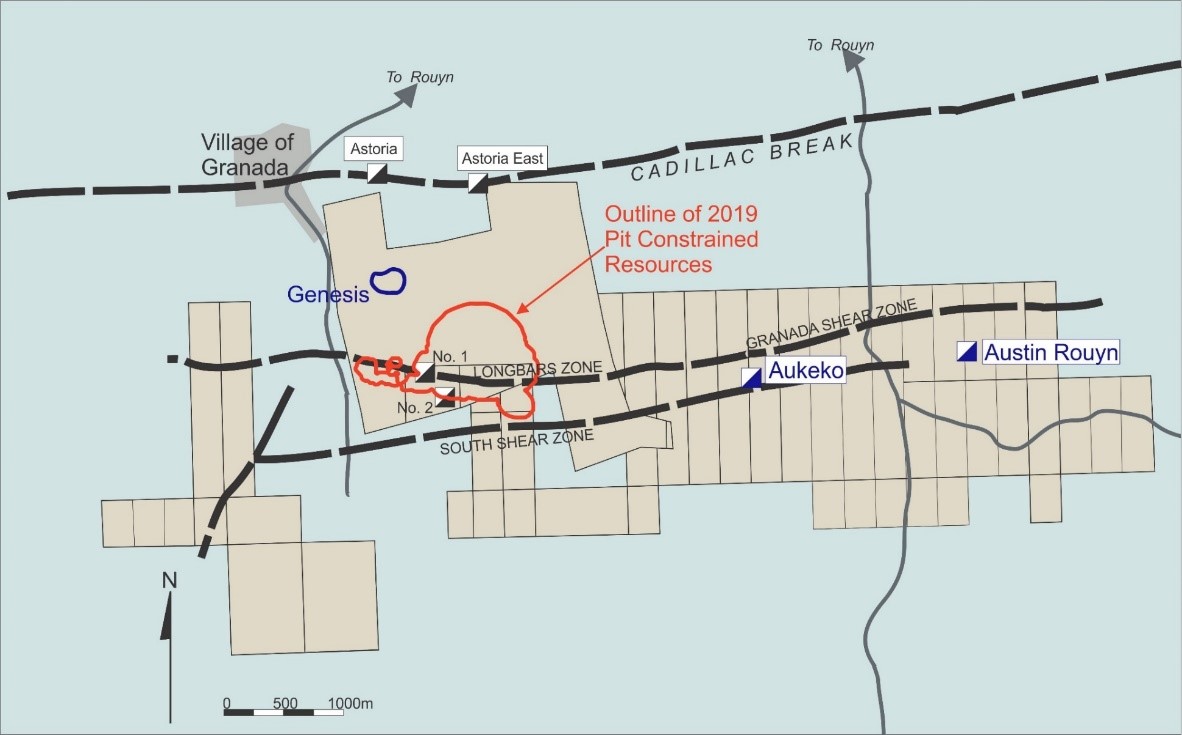

Ø Location: 15 minutes from Rouyn-Noranda Quebec. Situated in the heart of the famous Abitibi Greenstone Belt and along the prolific "Cadillac Trend".

Mining Method

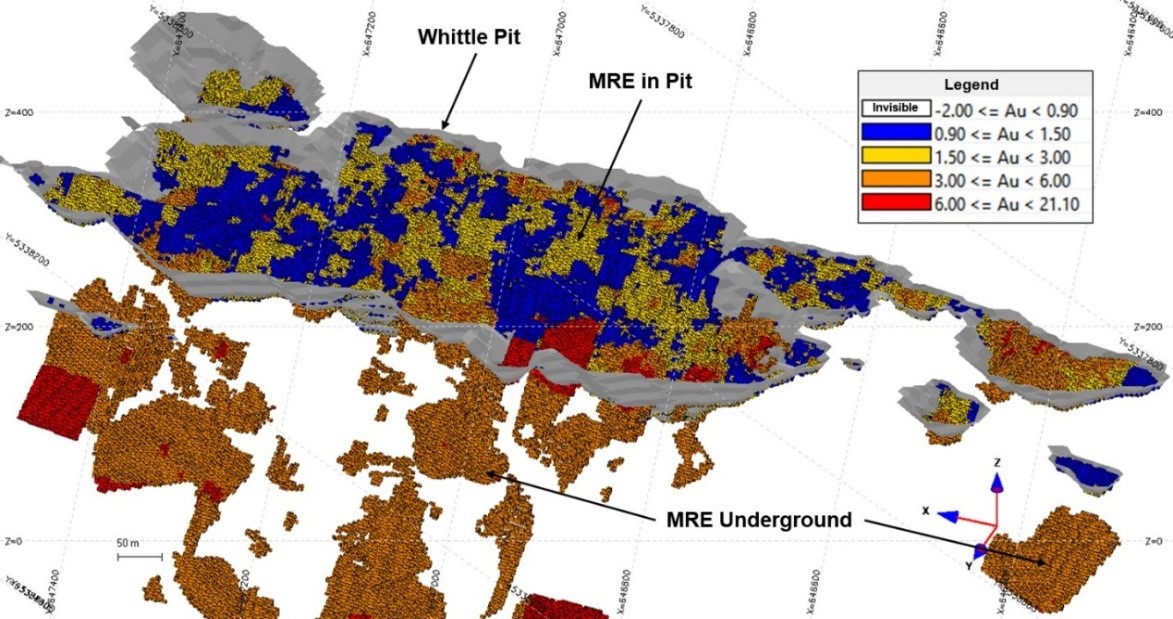

Open pit & underground operation.

Mineral Resource

The average grades for resources currently are 2 g/t for open pit and 4 g/t for underground. Planned to build a mill producing 80,000 to 100,000 oz Au per year.55.56 g/t native gold from a 1,220 Kg grab sample from Vein No. 1.

Type | Category | Tonnes | Au (g/t) | Gold Ounces |

In Pit | Measured1 | 3,756,000 | 1.89 | 228,000 |

Indicated | 1,357,000 | 2.55 | 111,000 | |

Measured+Indicated | 5,113,000 | 2.06 | 339,000 | |

Inferred | 34,000 | 11.29 | 12,000 | |

Underground | Measured | 37,000 | 4.22 | 5,000 |

Indicated | 807,000 | 4.02 | 104,000 | |

Measured+Indicated | 844,000 | 4.03 | 109,000 | |

Inferred | 1,244,000 | 6.33 | 253,000 |

*Cut-off grades are based on a gold price of US$1,600 per ounce, a foreign exchange rate of US$0.76 for CA$1, a gold recovery of 93%

*Pit constrained mineral resources are reported at a cut-off grade of 0.9 g/t Au within a conceptual pit shell

*Underground mineral resources are reported at a cut-off grade of 3.0 g/t Au within reasonably mineable volumes

Exploration Status

ü Permits in place to open-pit mine 550 t/day (“Rolling Start”).

ü NI 43-101 filed on March 15, 2021.

ü Numerous targets identified via magnetic survey and where past drilling intersected high-grade gold zones.

ü Targeting 2.5 to 3 million ounces with current 120,000-metre drill program – building on the existing 120,000 metres drilled.

ü 80% of potential 5.5 km east-west strike length remains unexplored.

Investment Highlights

ü 94.9% recoveryof gold by Gravity Separation with Cyanide Extraction.

ü High grade open pit & underground resources. Simple metallurgy. The highest grade intercepts at depth can be 107.8 g/t Au over 4 m.

ü Rare Earth discovered at the property in March, 2021.

ü Well established infrastructure, proximity to 10 gold mills.

ü Experienced management teamin metallurgy, milling, geology, exploration and mining.

Capital Structure

Recent Share Price | $ 0.155 |

Market Cap | $ 17,125,647 |

Shares Outstanding | 110,488,041 |

*3% net smelter royalty (NSR) to be paid as gold or cash dividend to shareholders after Granada production begins | |

*1% NSR Granada holds on properties owned by Canada Cobalt Works to be paid out as cash dividends to GGM shareholders | |

Company Requirement: Seek for investors in China.

Contact Information: Platform

Attachment Download: Company Presentation and Reports

Company Website: https://granadagoldmine.com/

Welcome to MiningComm Platform

Welcome to MiningComm Platform

Granada Gold Mine Inc.

Granada Gold Mine Inc. Return

Return MONTT GROUP

MONTT GROUP EMAIL:service@miningcomm.com

EMAIL:service@miningcomm.com TEL:0512-67629552

TEL:0512-67629552 ADDRESS:6/F, Block A, Suxin Mansion, No.88, Zhongxin Ave West, Suzhou Industrial Park, Jiangsu Province

ADDRESS:6/F, Block A, Suxin Mansion, No.88, Zhongxin Ave West, Suzhou Industrial Park, Jiangsu Province