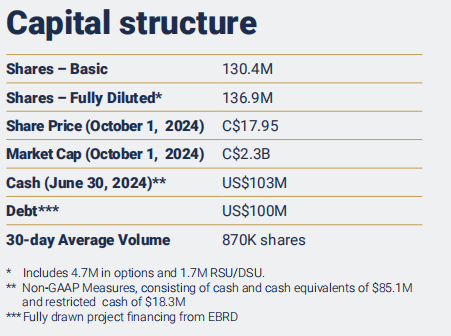

Company Profile:Aya Gold & Silver is a rapidly growing, Canada-based silver producer with operations in the Kingdom of Morocco. Aya is the only TSX-listed pure silver mining company, operating the high-grade Zgounder Silver Mine, Boumadine Mine (Au-Ag-Pb-Zn), Tirzzit Mine(Cu-Ag-Au), Tijirit Mine(Au), Imiter bis Mine(Ag-Au-Pb-Zn-Cu), Amizmiz Mine(Au) and Azegour Mine(Cu-Mo-W). Market Cap (October 1, 2024) C$2.3B.

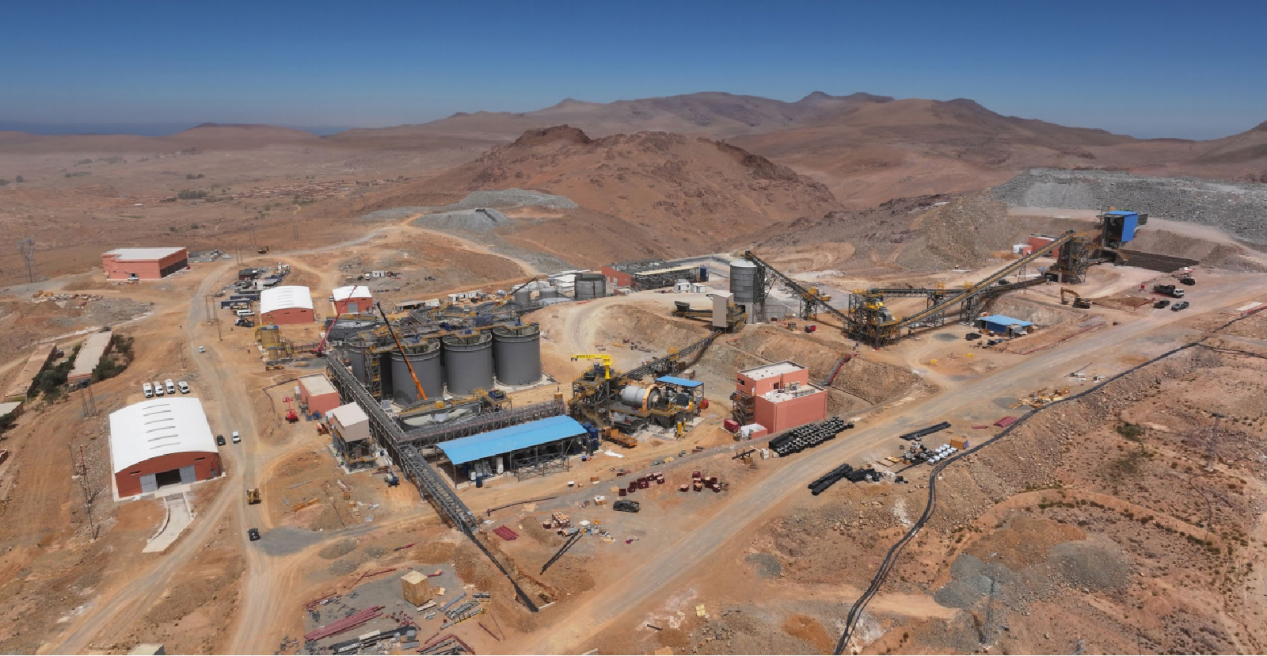

Zgounder

Zgounder Mine:

Location: Located in the central Anti-Atlas mountains, 260km east of Agadir in Morocco. Zgounder is the second most-important silver mine in Morocco after the Imiter Mine.

2024 silver production guidance: 1.6 – 1.8 million oz

Type of mine: underground

Current mining method: cut and fill

Processing method: flotation (500 tpd) – cyanidation (200 tpd)

Expansion to 2,700 tpd underway for expected commercial production in Q4-2024

Ownership: 100%

2022 mineral reserves: 8,590,000t at 257 g/t Ag for 70,876,000 oz

M&I mineral resources: 9,765,000t at 306 g/t Ag for 96,057,000 oz (December 13, 2021)

Inferred mineral resources: 542,000t at 367 g/t Ag for 6,395,000 oz (December 13, 2021)

2024 exploration: 30,000m drilling (mine permit) and 10,000m (regional permits)

Boumadine Mine (Au-Ag-Pb-Zn):

Location: in the region of Drâa-Tafilalet in the Anti-Atlas mountains about 240 km from Ouarzazate in western Morocco.

Ownership: Aya 85%-ONHYM 15% joint venture

Mining permits and exploration permits comprising 198 km²

2024 drilling program of 120,000m:

60,000m: explore and expand Main Zone’s 5.4km strike

60,000m: test new targets

April 2024 mineral resource estimate

2023 metallurgical test work:

Total recoveries of 89% for Ag, 85% for Au, 85% for Pb and 72% for Zn

Two step-process: 1) flotation and 2) oxidation (Albion Process™) with leaching

Completion of heliborne VTEM™ terrain, magnetic and radiometric geophysical surveys:

Data indicate presence of conductive anomaly down to at least 600m below surface along main trend

MobileMT airborne survey identified multiple potentially highly conductive anomalies to the west and south of Main Trend

Underground mining operations between ~1950s-1992

AYA Investment Highlights:

ØThe only TSX-listed pure silver mining company with assets in Morocco

ØStrong management and balance sheet;

ØFully funded expansion and exploration program

ØStable, underexplored, mining-friendly, jurisdiction

ØClear, near-term decarbonization plan, supported by expanded disclosure

ØZgounder Silver Mine is planned to expand operational capacity from 700 tpd to 2,700 tpd in 2024.

In 2024, Aya was added to the S&P / TSX Composite Index, demonstrating the company’s ability to execute on its expansion and exploration plans driving sustainable long-term value to shareholders.

Company Requirement: Seek for investors in China.

Contact Information: MiningCommPlatform

Attachment Download: Company Presentation

Company Website: https://ayagoldsilver.com

Welcome to MiningComm Platform

Welcome to MiningComm Platform

MiningComm

MiningComm Return

Return MONTT GROUP

MONTT GROUP EMAIL:service@miningcomm.com

EMAIL:service@miningcomm.com TEL:0512-67629552

TEL:0512-67629552 ADDRESS:6/F, Block A, Suxin Mansion, No.88, Zhongxin Ave West, Suzhou Industrial Park, Jiangsu Province

ADDRESS:6/F, Block A, Suxin Mansion, No.88, Zhongxin Ave West, Suzhou Industrial Park, Jiangsu Province