Company Profile

CN Version (click here to Chinese Profile 点击此处 跳转中文翻译)

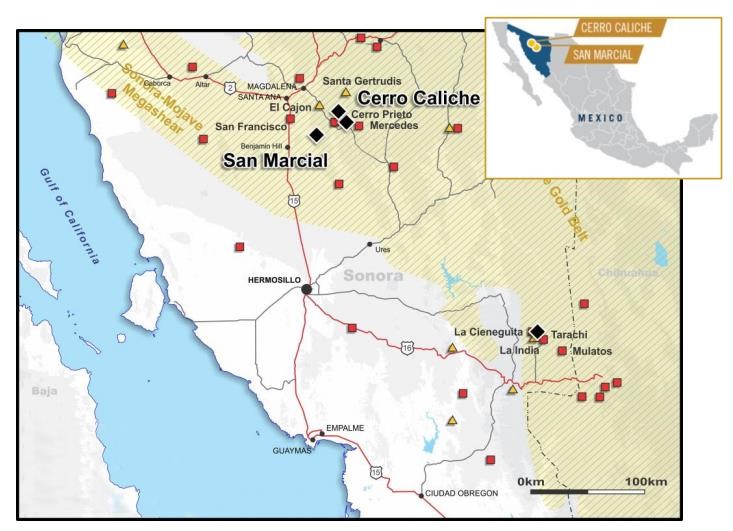

TSX listed Canadian-based dynamic gold and silver mineral exploration company. Owner of two gold and silver properties in the mining-friendly jurisdiction of Sonora, Mexico. Sonoro has a highly experienced management team of mining, business and finance professionals with a successful track record (12 copper and gold mines) in discovery through to resource development and production. The Company's current principal focus is the pursuit of a three-pronged exploration and development strategy for its Cerro Caliche Project.

Mineral Classification

Gold, Silver.

Gold Project Profile

Ø Flagship Project: Cerro Caliche project

Ø Location: Sonora State, Mexico.

Ø Mining Method

Open pit heap leach.

Ø Mineral Resource

ü Indicated Mineral Resources 19.9 Mt 290,000 oz AuEq @ 0.46 g/t

ü Inferred Mineral Resources 10.5 Mt 150,000 oz AuEq @ 0.44 g/t

ü Potential Target Mineralization 15 to 22.5 Mt containing: 125,000 to 285,000 oz AuEq

Ø Exploration Status

ü 498 Drill holes & 55,360 m of Drilling Data

ü Mineral Resource Estimate (MRE) Filed Mar 2023

ü Preliminary Economic Assessment (PEA) Filed Oct 2023

ü Permitting Phase for Near-Term Production

Ø TARGETED EXPANSION DRILLING PROGRAM:

ü Expand Higher-Grade Western Zones

ü Increase overall resource size

ü Increase resources within pit shells

ü Drill deeper into zones open to depth

ü Infill drilling to decrease strip ratio

Ø SHARE STRUCTURE:

Recent Share Price Range | $0.045-$0.09 |

Year High/Low | $0.045/$0.11 |

Average Monthly Volume (6 months) | 3.4M |

Market Capitalization | $10.5M |

Current Issued & Outstanding | 206.9M |

Shares Fully Diluted | 274818065 |

Ø PEA Highlights

ü Gold Price Per Ounce:$1800

ü Pre - Tax NPV (5%):$71.4M

ü Pre - Tax IRR:59%

ü After - Tax NPV (5%):$47.7M

ü After - Tax IRR:45%

ü Revenues:$535.6M

ü AuEq (oz) Recovered:297575

ü Initial Capital Costs:$15.5M

ü Sustaining Capital:$15.5M

ü Cash Costs per Ounce:$1295

ü AISC per Ounce:$1395

ü Payback Period:2.9Years

“The reason for my optimism was Sonoro’s plan to earmark USD $1 million of the desired financing for a core drilling program that would systematically assess the deeper potential of the structural trends within Cerro Caliche. This in situ resource of 182,000 ounces gold is small, but collectively the various zones within Cerro Caliche have an open pittable oxidized tonnage footprint in the range of 75-100 million tones.”

Commented by John A. Kaiser, an independent researcher

JOHN MICHAEL DARCH – Personal Profile 2024——The Chairman of SONORO CROP.

John Michael Darch began his career as a commercial banker with NatWest in the UK and the Royal Bank in Canada. In the 1980s, Darch shifted his focus to the natural resource sector and spent three decades co-founding six public companies and raising over USD $300 million to fund exploration, development, and operations. Among the more notable start-ups is Crew Development Corporation (now Crew Gold) which acquired and developed Greenland’s first gold mine and a major nickel-cobalt laterite deposit in Mindoro, Philippines. Crew also acquired the Johannesburg Stock Exchange listed Metorex Development and its operating mines and development projects in Africa.

John Michael Darch began his career as a commercial banker with NatWest in the UK and the Royal Bank in Canada. In the 1980s, Darch shifted his focus to the natural resource sector and spent three decades co-founding six public companies and raising over USD $300 million to fund exploration, development, and operations. Among the more notable start-ups is Crew Development Corporation (now Crew Gold) which acquired and developed Greenland’s first gold mine and a major nickel-cobalt laterite deposit in Mindoro, Philippines. Crew also acquired the Johannesburg Stock Exchange listed Metorex Development and its operating mines and development projects in Africa.

Metorex was subsequently listed on the London Stock Exchange and was eventually acquired by JinChuan Group Ltd. in 2011 for USD $1.3 billion.

Other companies co-founded by Darch include Nevada Goldfields (gold, USA), Botswana Diamondfields (diamonds, Botswana & South Africa) and South Crofty Holdings (tin, UK), Western GeoPower (geothermal development, Canada & California USA) and Thailand focused Asia Pacific Resources, whose subsidiary Asia Pacific Potash Corporation (APPC) discovered and developed to feasibility the Udon Thani projects, one of the world’s richest potash deposits.

APPC was acquired by Italian-Thai Development Pcl in 2006 and in 2022 received a mining license for the Udon Thani South project which is expected to produce 2Mt of high-grade sylvinite over 21 years. The Udon Thani North project has an estimated sylvinite resource of 558.2 Mt at 17.8% K2O.

In 2006, Darch became the principal backer and incubator of Doi Chaang Coffee, spending 10 years and USD $5 million transforming a struggling coffee cooperative of an impoverished hill tribe in northern Thailand into a thriving and sustainable community, with coffee growing and roasting school, a medical clinic and an international marketing and distribution channel. Today, Doi Chaang Coffee is an internationally recognized and award-winning premium coffee and has been the subject of extensive local and international media coverage, as well as a book and documentary entitled Beyond Fair Trade.

In late 2018, Darch returned to the natural resource sector and acquired a significant stake in Sonoro Gold Corp. Since being appointed Chairman of the Board, Darch has helped secure over CAD $23.9 million in equity financing to develop the Company’s flagship Cerro Caliche gold project in Sonora Mexico. The Company plans to initiate production with a 12,000 tonnes per day heap leach mining operation (HLMO) and utilize the generated cash flow to fund further exploration and development.

KENNETH MACLEOD – Personal Profile 2024——The President and CEO of SONORO CROP.

Kenneth MacLeod has over 40 years’ experience in managing, financing, and developing natural resource companies. Trained as a mechanical engineer with the British Steel Corporation, MacLeod emigrated to Canada to work as an engineering consultant in the design and construction of large industrial facilities within the mining, forestry, and petrochemicals sectors. In the early 1980s, MacLeod expanded his expertise to serve as an officer for an oil and gas producer. Later in the 1980s, he negotiated and managed the reverse takeovers and public listings of several American companies on the Canadian stock exchanges, including Azuray, Inc. and VAALCO Energy, Inc.

Kenneth MacLeod has over 40 years’ experience in managing, financing, and developing natural resource companies. Trained as a mechanical engineer with the British Steel Corporation, MacLeod emigrated to Canada to work as an engineering consultant in the design and construction of large industrial facilities within the mining, forestry, and petrochemicals sectors. In the early 1980s, MacLeod expanded his expertise to serve as an officer for an oil and gas producer. Later in the 1980s, he negotiated and managed the reverse takeovers and public listings of several American companies on the Canadian stock exchanges, including Azuray, Inc. and VAALCO Energy, Inc.

In 1994, MacLeod was appointed President and CEO of Kakanda Development Corp. which became the first foreign mining company to secure an agreement with Gécamines, the state mining enterprise for the Democratic Republic of Congo. After securing a USD $12 million capital raise, MacLeod oversaw the completion of a multi-year feasibility study on the Kakanda copper-cobalt project in Katanga Province as well as conducting exploration programs in Myanmar and Canada.

In 2001, MacLeod was appointed President and CEO of Western GeoPower Corp. where he successfully secured over USD $130 million in equity and debt financing for two geothermal projects. During his tenure, MacLeod oversaw the delineation of a large high-temperature geothermal reservoir at the Meager Creek geothermal project in British Columbia, Canada, as well as the completion of a deep drilling program and feasibility study, followed by permitting for a 35 MW geothermal power project at the Geysers geothermal field in Sonoma County, California.

In 2009, MacLeod founded Pan Pacific Power Corp. to acquire and develop renewable energy projects in the Philippines. Six projects were acquired, including a large hydro project in northern Luzon. Following the completion of engineering studies, the company’s Philippine subsidiary was sold to a Philippine conglomerate in 2014.

In 2014, MacLeod was appointed President and CEO of Sonoro Gold Corp. where he successfully negotiated the sale of the Chipriona gold/silver concession to Agnico Eagle Mines Limited and acquired the San Marcial gold property as well as the flagship Cerro Caliche gold/silver property in Sonora State, Mexico. With approximately CAD $24 million secured in equity financing, MacLeod successfully developed Cerro Caliche to the permitting phase for an initial 12,000 tonnes per day heap leach mining operation, with plans in place to expand the resource and life of mine through additional drilling to be funded from production revenues.

Company Requirement: Seek for EPC & finance investment partners.

Contact Information: MiningComm Platform

Attachment Download: Company Presentation and Reports

Company Website: https://sonorometals.com

Scan the below QR Code to follow us on Wechat Subscription, to explore more updated info of China Mining Market.

Welcome to MiningComm Platform

Welcome to MiningComm Platform

Sonoro Gold Corporation

Sonoro Gold Corporation Return

Return MONTT GROUP

MONTT GROUP EMAIL:service@miningcomm.com

EMAIL:service@miningcomm.com TEL:0512-67629552

TEL:0512-67629552 ADDRESS:6/F, Block A, Suxin Mansion, No.88, Zhongxin Ave West, Suzhou Industrial Park, Jiangsu Province

ADDRESS:6/F, Block A, Suxin Mansion, No.88, Zhongxin Ave West, Suzhou Industrial Park, Jiangsu Province