TORONTO, ON / ACCESSWIRE / November 22, 2022 / Power Nickel Inc. (the "Company" or "Power Nickel") (TSX- V:PNPN)(OTCBB:CMETF)(Frankfurt:IVVI) is pleased to announce it has completed its over-subscribed non-brokered private placement of 13,750,000 flow-through units (each, an "FT Unit") at a price of $0.20 per FT Unit and 14,425,000 non-flow-through units (each an "NFT Unit") at a price of $0.10 per NFT Unit, for aggregate gross proceeds of CAD$4,192,500. (the "Private Placement"). The Company has received conditional TSX Venture Exchange ("TSXV") approval for the Private Placement.

Each FT Unit consists of one common share of the Company that qualifies as a "flow-through share" (each, an "FT Share"), for purposes of the Income Tax Act (Canada) (the "ITA"), and one non-flow-through common share purchase warrant (each, a "Warrant"). Each Warrant is exercisable into one non-flow-through common share (each, a "Common Share") at an exercise price of $0.20 per Warrant for a period of five years from the date of issuance. Each NFT Unit consists of one Common Share and one Warrant. All securities issued under the Private Placement will be subject to a four-month and one-day statutory hold period.

In connection with the closing of the Private Placement, the Company paid finder's fees of $109,375 and issued 708,750 non-transferable finder's Warrants to certain finders in accordance with applicable securities laws and the policies of the TSXV. Each finder's warrant has the same terms as the Warrants but are non-transferable.

The Warrants are subject to an acceleration clause that entitles the Company to provide notice (the "Acceleration Notice") to holders that the Warrants will expire 30 days from the date the Company provides the Acceleration Notice. The Company can only provide the Acceleration Notice if the closing price of the Company's Common Shares on the TSXV is equal to or greater than $0.40 for 10 consecutive trading days. The Acceleration Notice can be provided at any time after the statutory hold period and before the expiry date of the Warrants.

The Company intends to use the gross proceeds from the sale of the FT Shares to incur eligible "Canadian exploration expenses", within the meaning of the ITA, that will qualify for the federal 30% Critical Mineral Exploration Tax Credit pursuant to the draft legislation released on August 9, 2022. The Company intends to use approximately $800,000 of the proceeds from the sale of the NFT Units to settle an outstanding debenture. The Company intends to use the remainder of the proceeds from the sale of the NFT Units for general administrative and working capital purposes.

Two insiders of the Company invested aggregate funds of $540,000 into the Private Placement in NFT Units, which is considered a "related party transaction" within the meaning of Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The Company intends to rely on the exemptions from the formal valuation and minority shareholder approval requirements of MI 61-101 as the Company is not listed on a specified

market (as set out in Section 5.5(b) of MI 61-101) and the aggregate fair market value of the NFT Units being subscribed to by the insiders does not exceed CAD $2,500,000 (as set out in Section 5.7(1)(b) of MI 61-101).

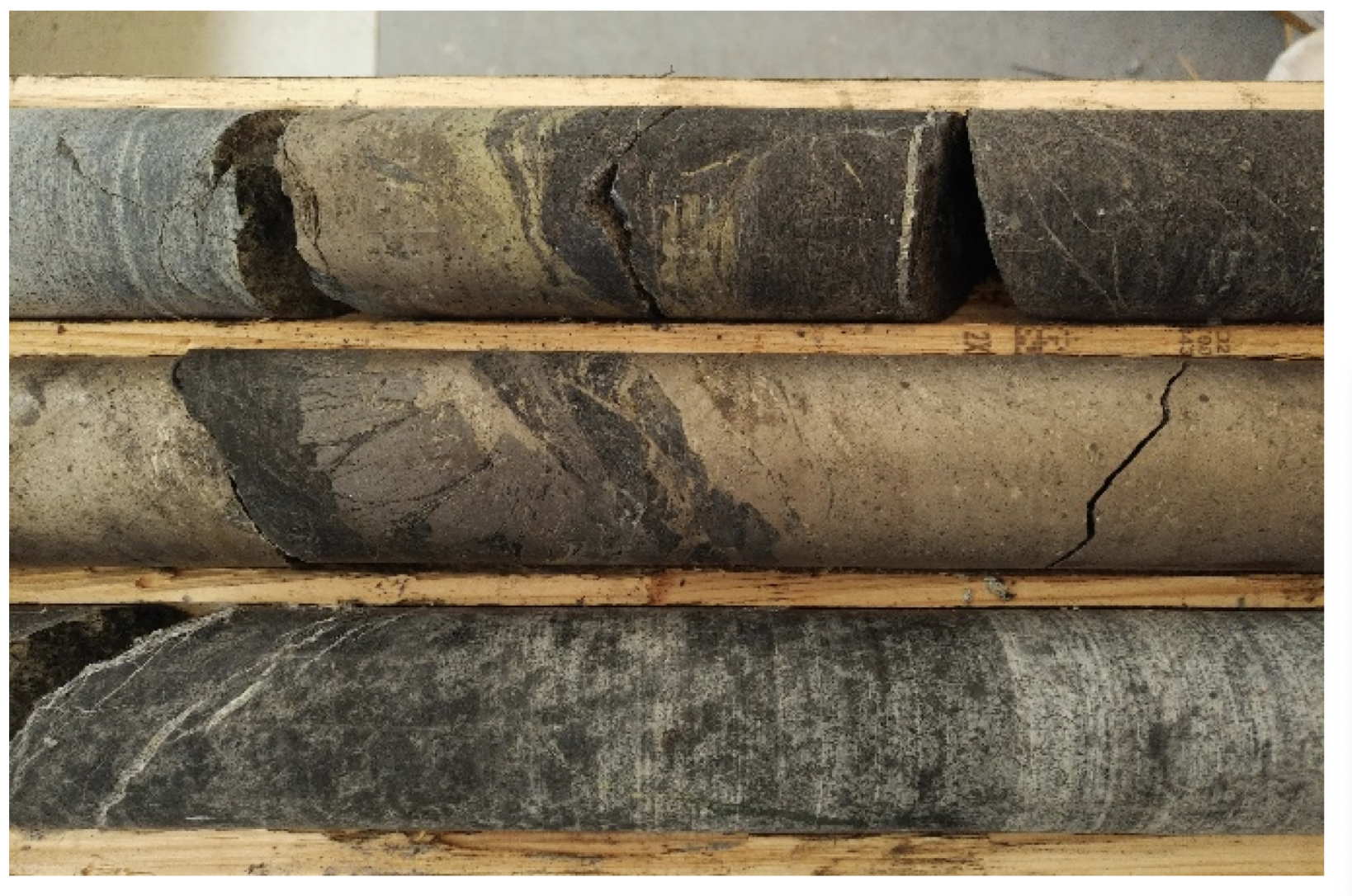

"With the new financing we have expanded our drill program and now plan to keep drilling through mid-December and start up again in Mid January. We had planned to drill 5000 meters and will now add an additional 7500 to 10,000 meters as we continue to like what we see with our drilling program." Commented Power Nickel CEO Terry Lynch. "Sections like these from hole PN 22-009 certainly were exciting to see.

About Power Nickel Inc.

Power Nickel is a Canadian junior exploration company focusing on high-potential copper, gold, and battery metal prospects in Canada and Chile.

Welcome to MiningComm Platform

Welcome to MiningComm Platform

MONTT GROUP

MONTT GROUP EMAIL:service@miningcomm.com

EMAIL:service@miningcomm.com TEL:0512-67629552

TEL:0512-67629552 ADDRESS:6/F, Block A, Suxin Mansion, No.88, Zhongxin Ave West, Suzhou Industrial Park, Jiangsu Province

ADDRESS:6/F, Block A, Suxin Mansion, No.88, Zhongxin Ave West, Suzhou Industrial Park, Jiangsu Province