As demand for battery metals increases in line with the transition to EVs, mining company Power Nickel is establishing itself as a major player in the clean energy market.

NISK

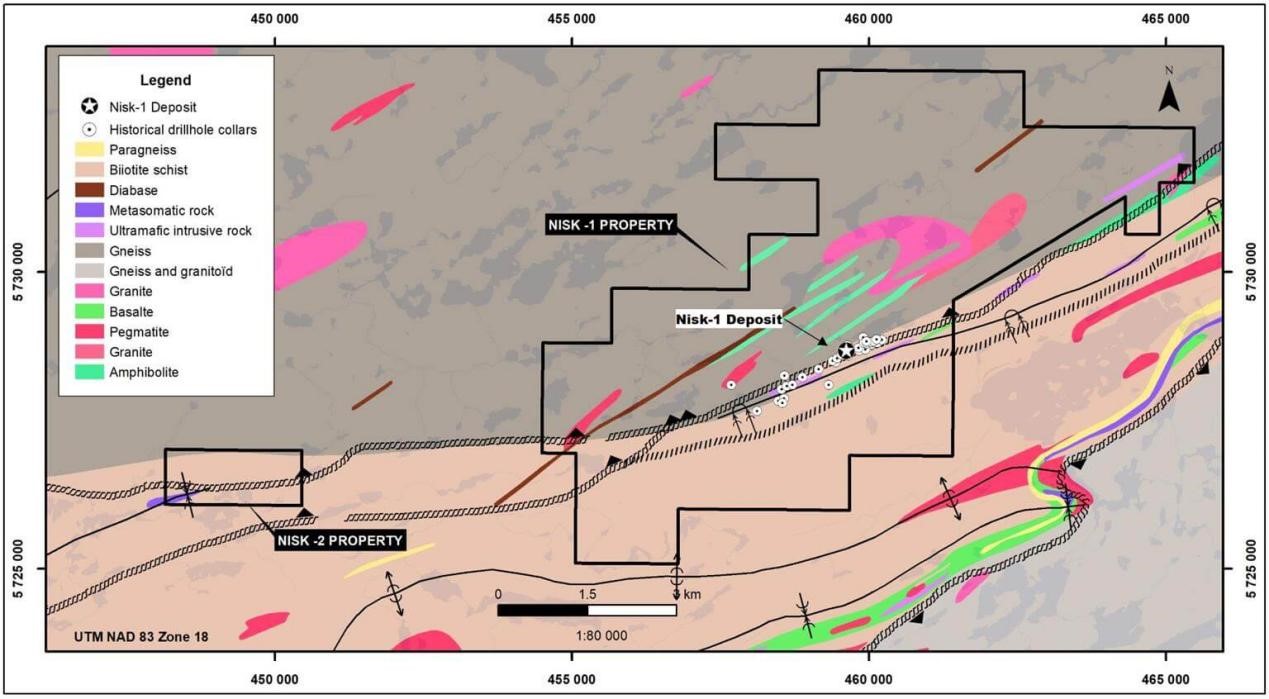

NISK is Power Nickel’s flagship project, which is ideally located in an active mining region of Quebec. The market is strong for multiple battery metals and NISK has got them all, with mineralisations in nickel, copper, cobalt, palladium, and platinum.

The NISK deposit is open at depth and along strike. Power Nickel has completed Q4 2021 – a 2500m drill programme targeting high-grade nickel and copper mineralisation for EVs.

Further prospects

The company owns 100% of Consolidation Gold and Silver and plans to use a palm of arrangements to dividend that asset out and create a new company; 20% of which will be owned by Power Nickel shareholders, with 80% owned by Power Nickel.

Consolidation Gold and Copper focuses on the acquisition and exploration of copper and gold in Chile and British Columbia’s famous Golden Triangle. At the heart of the Golden Triangle lies the Golden Ivan Project, which hosts two known mineral showings described to be polymetallic veins that contain quantities of silver, lead, zinc, +/- gold, and +/- copper.

The company also holds a 3% royalty for Copaquire, a copper moly deposit it discovered, which is held by Teck Resources.

Positioned to meet the increasing demand

At a current market cap of CAD$12m, this company is trading at a deep discount to its peers. Pound for pound, Power Nickel offers a great value deal for nickel exploration.

Welcome to MiningComm Platform

Welcome to MiningComm Platform

MONTT GROUP

MONTT GROUP EMAIL:service@miningcomm.com

EMAIL:service@miningcomm.com TEL:0512-67629552

TEL:0512-67629552 ADDRESS:6/F, Block A, Suxin Mansion, No.88, Zhongxin Ave West, Suzhou Industrial Park, Jiangsu Province

ADDRESS:6/F, Block A, Suxin Mansion, No.88, Zhongxin Ave West, Suzhou Industrial Park, Jiangsu Province