As global gold demand continues to surge, Sonoro Gold Corp. (TSXV: SGO) (OTCQB:SMOFF) (FRA: 23SP) is emerging as a compelling junior miner poised to capitalize on Mexico’s rich mineral endowment. With its flagship Cerro Caliche Project in Sonora State advancing toward production, the company is attracting attention from investors seeking exposure to high-potential gold assets in mining-friendly jurisdictions.

A High-Grade Asset in a Prime Location

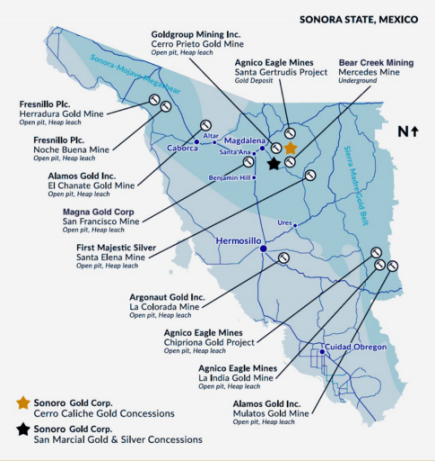

Cerro Caliche, spanning 1,200 hectares, is strategically located in Sonora State, Mexico, between the two world-class mining districts of the Sierra Madre Gold Belt and the Sonora-Mojave Megashear. The project is situated close to several gold-silver mining operations, including Bear Creek Mining’s Mercedes mine and Agnico Eagle’s advanced Santa Gertrudis project, with access to a high-skilled workforce and first-class infrastructure, reducing execution hurdles.

With only 30% of the property’s identified mineralized zones drilled and assayed to date, an updated Mineral Resource Estimate (MRE) was filed in March 2023. According to the MRE, Cerro Caliche hosts a near-surface, oxide gold deposit with a NI 43-101 resources of

· Indicated Mineral Resources of 19.9 million tonnes grading 0.44 g/t Au (280,000 oz Au) and 3.5 g/t Ag (2,240,000 oz Ag)

· Inferred Mineral Resources of 10.5 million tonnes grading 0.42 g/t Au (140,000 oz Au) and 4.0 g/t Ag (1,345,000 oz Ag).

· Potential Target Mineralization of 15 to 22.5 million tonnes containing 125,000 to 285,000 oz AuEq

The project’s heap-leach-friendly mineralization and straightforward metallurgy suggest lower capital and operational costs—a critical advantage in today’s cost-sensitive market.

PEA Highlights:

ü Pre-Tax net present value discounted at 5% (“NPV5”) of USD $71.4 million

ü Pre-Tax Internal Rate of Return (“IRR”) of 59%

ü After-Tax NPV5 of USD $47.7 million with an IRR of 45%

ü Gold recovery of 72% and silver recovery of 27%

ü 9-year LOM with 297,575 ounces (“oz”) of gold equivalent (“AuEq”)

ü LOM annual average production of 33,000 oz AuEq at 0.45 g/t AuEq

ü Initial CAPEX costs of USD $15.5 million, including USD $1.83 million in contingency

ü Sustaining capital costs of USD $15.5 million

ü Cash(1) operating costs of USD $1,295/oz AuEq

ü AISC(2) of USD $1,395/oz AuEq

ü Payback period of 2.9 years

Note: All currencies are reported in U.S. dollars. Base case parameters assume $1,800/oz gold and $23/oz silver.

(1) Cash operating costs include mining, crushing, processing, assaying, and administration.

(2) All-in-Sustaining Costs include cash costs plus sustaining, refining and reclamation costs, as well as 2% royalty buyout.

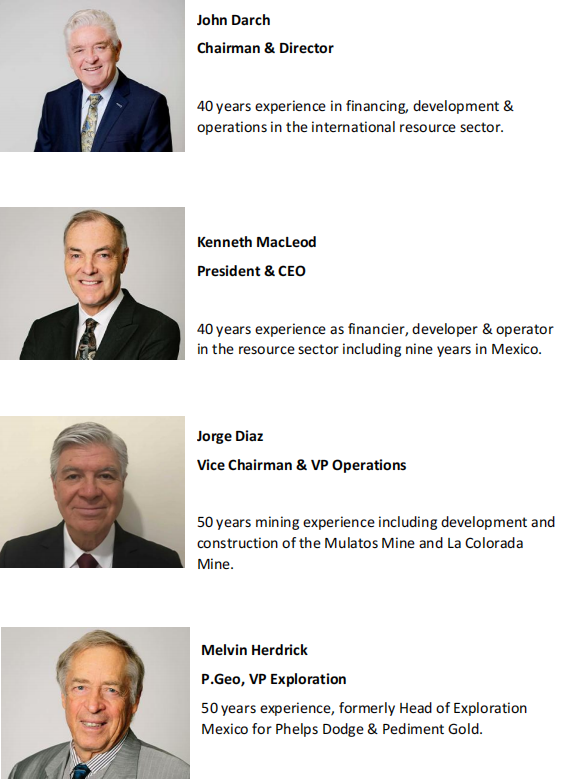

Experienced Management Team

Sonoro has a highly experienced management team in financing & developing mineral resources which is the key to success within junior markets.

Compared to the Peers

When compared to venture-listed Silver Tiger Metals which focused on placing their El Tigre project into production in northeastern Sonora, Sonoro Gold with a market cap of $19 million and 440,000 gold equivalent ounces across all categories, translates to about $43 in valuation per ounce in the ground while Silver Tiger Metals contains 1.6 million measured and indicated gold equivalent ounces across all categories, plus 1.0 million inferred equivalent ounces with market cap of $128 million which translates to about $49 in valuation per gold equivalent ounce.

With estimated average annual production of 33,000 ounces, compared to Heliostar Metals, who is currently valued at $221 million with current annual production of just under 21,000 gold equivalent ounces, or Avino Silver, who in 2024 produced about 31,000 gold equivalent ounces, whom is currently valued at $349 million, Sonoro stands out among the peers.

Deep Dive, a Canadian financial analysis platform focused on educating young investors about junior markets which provides unbiased stock research to help investors make informed decisions, recently analyzed and reported on Sonoro's Cerro Caliche project. Given the outsized role mining plays in the economy, a flurry of mining permits are expected to be issued in a near term which will bring Cerro Caliche into production. For more analysis, please refer to the following link to access a video of Sonoro Gold's profile, published by Deep Dive on YouTube Channel

https://www.youtube.com/watch?v=Ssf93Ts3QgY

In conclusion

President Sheinbaum emphasized the need for a review, not because of “lobbies of large companies”, but the importance of mining to the economy of Mexico and environmental protections. With Mexico's legal framework for mining to be clearer, Sonoro Gold represents a high-reward proposition in the junior mining sector. For investors betting on gold’s bullish macro trends and Mexico’s mining resurgence, Sonoro Gold warrants a closer look.

If you are interested in Sonoro and Cerro Caliche Gold project, please feel free to contact MiningComm Platform for further information.

Welcome to MiningComm Platform

Welcome to MiningComm Platform

MONTT GROUP

MONTT GROUP EMAIL:service@miningcomm.com

EMAIL:service@miningcomm.com TEL:0512-67629552

TEL:0512-67629552 ADDRESS:6/F, Block A, Suxin Mansion, No.88, Zhongxin Ave West, Suzhou Industrial Park, Jiangsu Province

ADDRESS:6/F, Block A, Suxin Mansion, No.88, Zhongxin Ave West, Suzhou Industrial Park, Jiangsu Province