June 9, 2021: Rouyn Noranda, QC - Granada Gold Mine Inc. (TSXV: GGM) (the “Company” or “Granada”) is pleased to announce that the Company has closed a flow-through private placement financing raising gross proceeds of $1,000,000. The Company has issued 5,714,285 flow-through shares at a price of $0.175 per flow-through share, subject to TSX Venture Exchange (“Exchange”) approval.

GloRes Securities Inc., the lead finder for the financing, was paid $70,000 in cash and 300,000 finder’s warrants. An additional 100,000 finder warrants were also paid. Each finder warrant is exercisable at $0.175 per share for two years from closing. The finder’s fees paid in connection with the private placement are subject to Exchange approval.

All securities issued in connection with the private placement are subject to a four-month and a day hold period expiring on October 10, 2021, in accordance with applicable Securities Laws.

The proceeds of the flow-through Private Placement will be used for surface exploration, trenching, and historical resampling of drill core on the Company’s Granada Gold Property in Québec.

Updated Mineral Resource

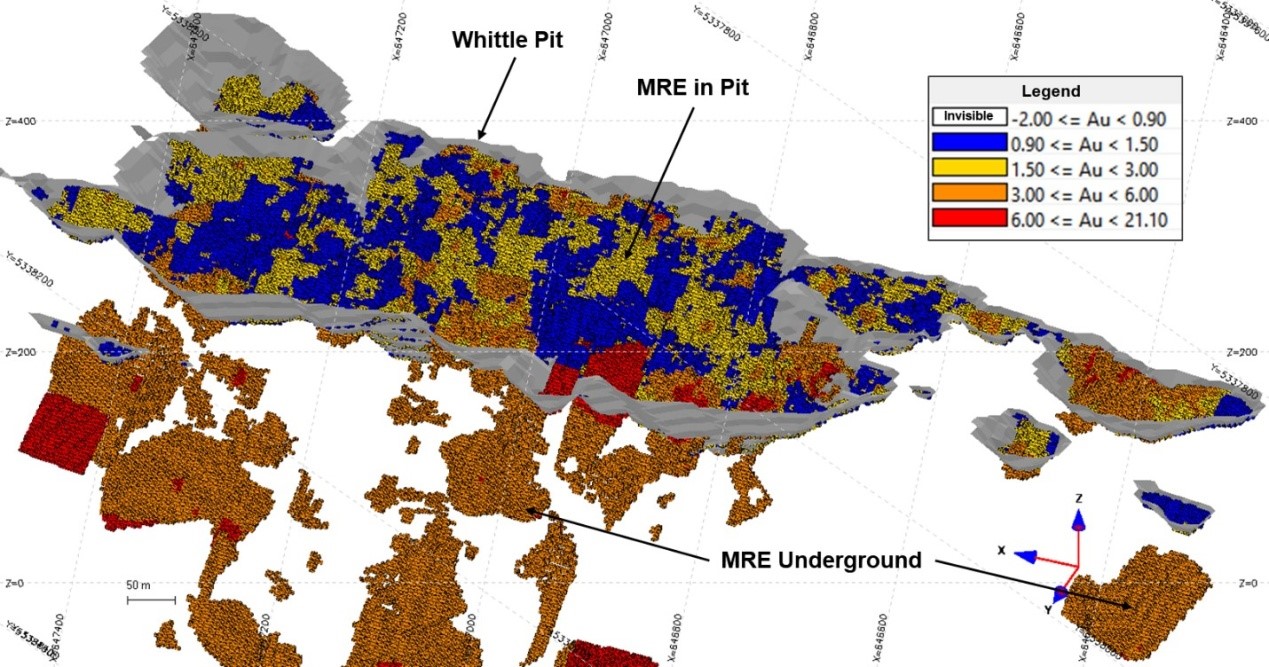

The updated resource at the Company’s Granada Gold project in Rouyn-Noranda, Quebec was estimated by SGS Canada and outlined in a January 29, 2021 news release. The final report was filed March 15, 2021 with an Effective date of December 15, 2020. The 43-101 Technical Report is titled: Granada Gold Project Mineral Resource Estimate Update, Rouyn-Noranda, Quebec, Canada authored by Yann Camus, P.Eng. and Maxime Dupéré, B.Sc, géo. Both of SGS Canada Inc.

Updated Mineral Resource Estimate Base Case with Details Between the Open Pit Portion and the Underground Portion

Type | Category | Tonnes | Au (g/t) | Gold Ounces |

In Pit | Measured1 | 3,756,000 | 1.89 | 228,000 |

Indicated | 1,357,000 | 2.55 | 111,000 | |

Measured+Indicated | 5,113,000 | 2.06 | 339,000 | |

Inferred | 34,000 | 11.29 | 12,000 | |

Underground | Measured | 37,000 | 4.22 | 5,000 |

Indicated | 807,000 | 4.02 | 104,000 | |

Measured+Indicated | 844,000 | 4.03 | 109,000 | |

Inferred | 1,244,000 | 6.33 | 253,000 |

1. Cut-off grades are based on a gold price of US$1,600 per ounce, a foreign exchange rate of US$0.76 for CA$1, a gold recovery of 93%

2. Pit constrained mineral resources are reported at a cut-off grade of 0.9 g/t Au within a conceptual pit shell

3. Underground mineral resources are reported at a cut-off grade of 3.0 g/t Au within reasonably mineable volumes

The Company is in possession of all mining permits required to commence the initial mining phase, known as the “Rolling Start”, which allows the company to mine up to 550 tonnes per day.

About Granada Gold Mine Inc.

Granada Gold Mine Inc. continues to develop the Granada Gold Property near Rouyn-Noranda, Quebec. Approximately 120,000 meters of drilling has been completed to date on the property, focused mainly on the extended LONG Bars zone which trends 2 kilometers east-west over a potential 5.5 kilometers of mineralized structure. The highly prolific Cadillac Break, the source of more than 75 million plus ounces of gold production in the past century, cuts through the north part of the Granada property, but is not necessarily indicative of mineralization hosted on the company’s property.

The Granada Shear Zone and the South Shear Zone contain, based on historical detailed mapping as well as from current and historical drilling, up to twenty-two mineralized structures trending east-west over five and a half kilometers. Three of these structures were mined historically from four shafts and three open pits. Historical underground grades were 8 to 10 grams per tonne gold from two shafts down to 236 m and 498 m with open pit grades from 3.5 to 5 grams per tonne gold.

Welcome to MiningComm Platform

Welcome to MiningComm Platform

MONTT GROUP

MONTT GROUP EMAIL:service@miningcomm.com

EMAIL:service@miningcomm.com TEL:0512-67629552

TEL:0512-67629552 ADDRESS:6/F, Block A, Suxin Mansion, No.88, Zhongxin Ave West, Suzhou Industrial Park, Jiangsu Province

ADDRESS:6/F, Block A, Suxin Mansion, No.88, Zhongxin Ave West, Suzhou Industrial Park, Jiangsu Province